Debt recycling is a financial strategy that involves using your existing debts to create wealth and financial stability. By understanding the concept of debt recycling and implementing the right strategies, you can turn your liabilities into valuable assets.

This article will explore the basic principles of debt recycling, its role in financial management, the process involved, the benefits it offers, and the potential risks and challenges you may encounter. Additionally, we will discuss various debt recycling strategies that can help you achieve long-term prosperity.

Understanding the Concept of Debt Recycling

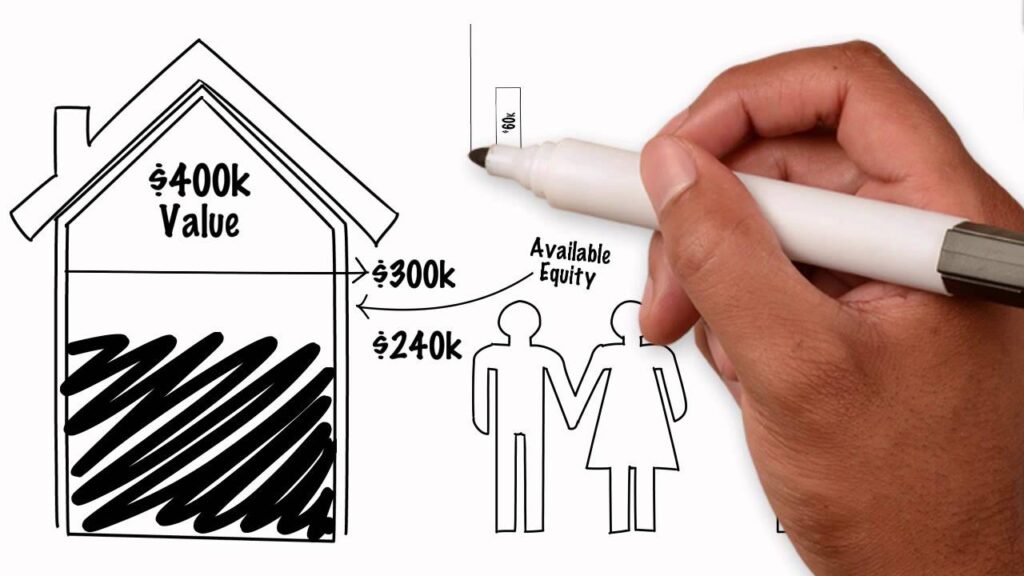

Debt recycling is a concept that revolves around leveraging your existing debt to generate more wealth. The basic principle behind this strategy is to use the equity in your home or property to invest in income-generating assets such as shares or property. By doing so, you can potentially increase your investment returns and build more wealth over time.

Debt recycling is different from traditional ways of managing debt because it focuses on turning liabilities into assets, rather than simply paying off debts. It allows you to make your debt work for you by using it as a tool to create wealth and financial security.

See Also: Building a Robust Plan for Financial Success

The Basic Principle of Debt Recycling

The fundamental principle of debt recycling is to redirect non-deductible debt, such as the mortgage on your home, towards deductible debt, such as an investment loan. By using the equity in your property to invest in income-producing assets, you can potentially offset the non-deductible debt with the tax deductions from the investment loan. This can result in a reduction of your overall tax liability and increase your available funds for further investment.

For example, let’s say you have a mortgage on your home with a high-interest rate. Instead of solely focusing on paying off this debt, you can explore the option of using the equity in your property to invest in a rental property. By doing so, you can generate rental income that can be used to offset the mortgage payments on your primary residence. This not only reduces your non-deductible debt but also creates a new income stream that can contribute to your overall financial well-being.

Furthermore, debt recycling allows you to take advantage of the potential capital growth of the income-generating assets you invest in. Over time, as the value of these assets increases, you can leverage this growth to further expand your investment portfolio and increase your wealth. This compounding effect can have a significant impact on your long-term financial goals.

The Role of Debt Recycling in Financial Management

Debt recycling plays a crucial role in effective financial management. It allows you to optimize your debt by leveraging it to create wealth over time. By strategically managing your debts, you can build a strong financial foundation and achieve long-term prosperity.

Debt recycling helps you make the most of your existing debt by identifying opportunities to invest in assets that generate income. This can potentially increase your cash flow and provide you with a sustainable source of wealth.

Moreover, debt recycling encourages a proactive approach to financial planning. It requires you to assess your current financial situation, evaluate your investment options, and make informed decisions about how to allocate your resources. This level of financial engagement can lead to a deeper understanding of your financial goals and a greater sense of control over your financial future.

It is important to note that debt recycling should be approached with caution and careful consideration. It is essential to seek professional advice from financial experts who can assess your individual circumstances and provide tailored recommendations. This will ensure that you make informed decisions that align with your financial goals and risk tolerance.

In conclusion, debt recycling offers a unique approach to managing debt and building wealth. By leveraging your existing debt to invest in income-generating assets, you can potentially increase your investment returns and create a sustainable source of wealth. However, it is crucial to approach debt recycling with careful planning and seek professional advice to maximize its benefits and mitigate potential risks.

The Process of Debt Recycling

Debt recycling involves several steps that you need to carefully navigate to ensure a successful outcome. The process can be summarized as follows:

Identifying Suitable Debts for Recycling

Before you begin the debt recycling process, it’s essential to identify the debts that are suitable for recycling. Typically, this includes your non-deductible debts, such as your home mortgage. These debts have little tax benefit and can be redirected towards deductible debts that offer potential tax advantages.

However, it’s important to note that not all non-deductible debts are suitable for recycling. Some debts may have early repayment penalties or unfavorable terms that make them unsuitable for this strategy. Therefore, it’s crucial to carefully review the terms and conditions of your debts before proceeding.

Additionally, it’s crucial to assess the risk and potential return of your investment options before proceeding with debt recycling. Conduct thorough research and seek professional advice to determine the most suitable assets to invest in. Consider factors such as market trends, historical performance, and your own risk tolerance.

Steps in the Debt Recycling Process

- Evaluate your current financial situation and establish your investment goals.

- Assess the equity in your property and determine the amount available for debt recycling.

- Identify suitable investment opportunities that align with your risk tolerance and financial objectives.

- Obtain the necessary funds to invest in income-generating assets by refinancing your non-deductible debt.

- When refinancing your non-deductible debt, it’s important to carefully consider the interest rates, fees, and repayment terms offered by different lenders. Compare multiple options to ensure you secure the most favorable terms.

- Invest the funds in the chosen assets and monitor their performance regularly.

- While investing, it’s crucial to stay informed about market trends and make informed decisions. Regularly review the performance of your chosen assets and make adjustments if necessary.

- Utilize any potential tax deductions to further reduce your non-deductible debt and accelerate wealth creation.

- Consult with a tax professional to understand the tax implications of your investment strategy. They can help you identify and maximize any available tax deductions and ensure compliance with relevant laws and regulations.

By following these steps and staying proactive in managing your debt recycling strategy, you can potentially reduce your non-deductible debt and create wealth through strategic investments.

Benefits of Debt Recycling

Debt recycling offers numerous benefits that can significantly impact your financial well-being. By employing this strategy, you can enhance your financial stability and accelerate the creation of wealth.

Enhancing Financial Stability

Through debt recycling, you can diversify your investment portfolio and reduce dependency on a single asset, such as your home. By spreading your investments across various income-generating assets, you can mitigate potential risks and increase your overall financial stability.

For example, let’s say you currently have all your investments tied up in real estate. While real estate can be a lucrative investment, it is not without its risks. By using debt recycling, you can take some of the equity from your property and invest it in other assets, such as stocks, bonds, or even a small business. This diversification helps protect you from the fluctuations of a single market and provides a more stable financial foundation.

In addition, debt recycling allows you to optimize your debt structure by transforming non-deductible debt into tax-deductible debt. This can result in a reduction of your interest payments over time and free up cash flow for further investment or debt reduction.

Imagine you have a mortgage on your home and a personal loan for a car. Both of these debts are non-deductible, meaning you cannot claim the interest paid on them as a tax deduction. However, by using debt recycling, you can refinance your mortgage and consolidate your personal loan into a new loan that is tax-deductible. This not only lowers your overall interest rate but also provides you with potential tax benefits, ultimately improving your financial stability.

Accelerating Wealth Creation

One of the key advantages of debt recycling is its ability to accelerate wealth creation. By capitalizing on the potential tax advantages and leveraging your existing debt, you can amplify your investment returns and generate more wealth in a shorter period.

Let’s say you have a significant amount of equity in your home. Instead of leaving that equity dormant, you can use debt recycling to access it and invest in income-generating assets. By doing so, you are leveraging your existing debt to acquire additional assets that have the potential to appreciate in value or generate passive income.

The income generated from your investment assets can be reinvested or used to pay off your non-deductible debt. This continuous cycle helps you accumulate assets and accelerate the growth of your wealth over time.

For instance, if you invest the equity from your home in a diversified portfolio of stocks and bonds, you can potentially earn dividends and interest income. This additional income can then be reinvested, compounding your returns and accelerating the growth of your wealth. Over time, this strategy can have a significant impact on your overall financial well-being.

In conclusion, debt recycling offers a range of benefits that can greatly improve your financial situation. By enhancing your financial stability through diversification and optimizing your debt structure, as well as accelerating wealth creation through leveraging and reinvesting, you can take control of your finances and pave the way for long-term prosperity.

Risks and Challenges in Debt Recycling

While debt recycling offers significant benefits, it’s important to be aware of the potential risks and challenges involved. By understanding and managing these risks effectively, you can mitigate potential negative outcomes.

Potential Risks Involved

Investing in income-generating assets involves inherent risks, including market volatility and asset performance. It’s crucial to carefully assess the risk-return profile of your investments and diversify your portfolio to minimize potential losses.

Additionally, any changes in interest rates or economic conditions may impact the tax advantages and overall feasibility of your debt recycling strategy. Stay informed and adapt your strategy accordingly to navigate potential risks successfully.

Overcoming Challenges in Debt Recycling

To overcome challenges in debt recycling, it’s essential to seek professional advice from financial experts who specialize in this field. They can help you assess your financial situation, establish realistic goals, and develop a tailored debt recycling strategy that suits your needs.

Regular monitoring and review of your investments are also crucial. Stay informed about market trends, seek professional guidance when needed, and adjust your strategy as necessary to ensure the ongoing success of your debt recycling approach.

Debt Recycling Strategies for Prosperity

When it comes to debt recycling, selecting the right strategy for your financial goals is key. Consider the following strategies to maximize the benefits and achieve long-term prosperity.

Choosing the Right Debt Recycling Strategy

There are several debt recycling strategies to explore, each with its advantages and considerations. Common strategies include direct equity investment, using an investment trust, or investing in shares or managed funds. It’s crucial to analyze each strategy carefully, considering factors such as risk tolerance, investment objectives, and tax implications.

Consult with financial professionals who specialize in debt recycling to determine the most suitable strategy based on your unique circumstances and goals.

Implementing Debt Recycling for Long-Term Prosperity

Once you have chosen a suitable debt recycling strategy, it’s important to implement it effectively for long-term prosperity. Regularly review your investment performance, reassess your goals, and make necessary adjustments to stay on track.

Keep up-to-date with changing economic conditions, tax laws, and market trends. This knowledge will enable you to optimize your debt recycling strategy and ensure that it remains aligned with your long-term financial aspirations.

In conclusion, debt recycling is a powerful financial strategy that can turn your liabilities into assets and pave the way for prosperity. By understanding the concept, carefully following the process, and implementing the right strategies, you can enhance your financial stability, accelerate wealth creation, and achieve long-term prosperity. While there are risks and challenges involved, seeking professional advice and staying informed will enable you to overcome these obstacles successfully. Start exploring the potential of debt recycling and unlock new avenues for financial growth and security.